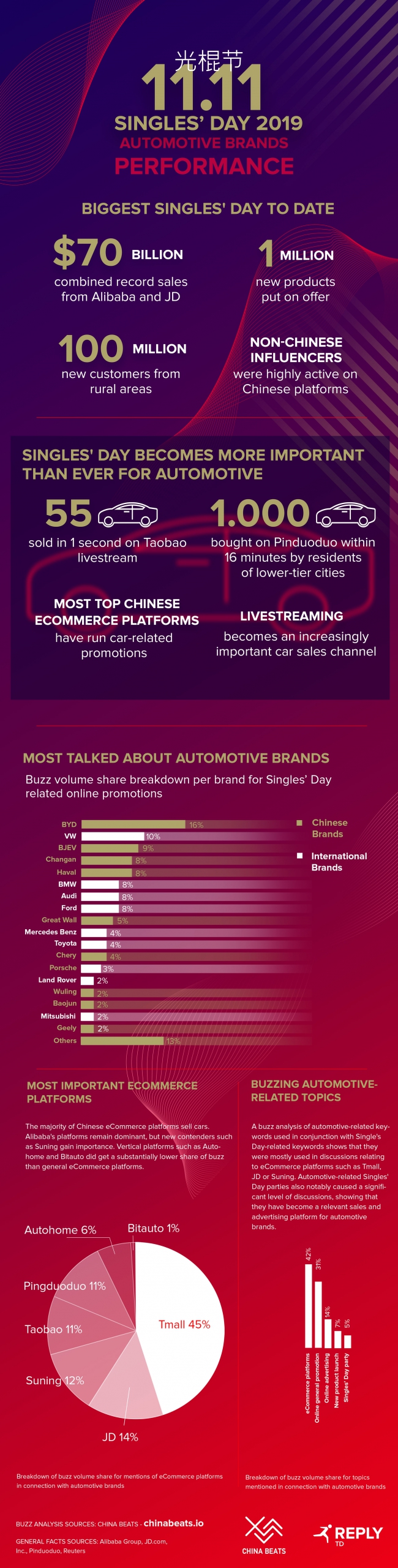

On the occasion of this years‘ Singles‘ Day, TD Reply conducted an online buzz analysis focusing on automotive brands. All relevant Chinese internet platforms were taken into consideration. Among the five car brands most talked about over the course of Singles’ Day advertising campaigns in China, Volkswagen came second, with the remaining four top spots taken by Chinese automotive manufacturers. Among the sales platforms, Tmall, JD, and Suning played the most important role. In general, it became apparent that Singles’ Day has become significantly more important for advertising and sales activities in the automotive industry today.

In contrast to consumer electronics and fashion, little attention has been paid to the importance of cars on Singles’ Day in China. Yet on Singles’ Day in 2016, Chinese eCommerce market leader Alibaba announced that around 100,000 cars were sold within 24 hours on its sales platforms. Against that background, TD Reply decided to conduct an online buzz analysis to bring some light to this potential opportunity. With its Beijing office operating since 2010 and working with many of the world’s leading automotive brands, the marketing and innovation consultants have had their finger on the pulse of the Chinese market.

The online buzz is calculated on the basis of comments and mentions in social media posts, as well as relevant news articles. The main goal of the analysis was to find out which car brands were most discussed by Chinese consumers on Singles’ Day, which sales platforms were most important in this respect, and to what extent cars generally play a prominent role on Singles’ Day. All relevant Chinese e-commerce, social media, search and news platforms were considered. The analysis used China Beats, a data-driven market intelligence solution developed by TD Reply for the Chinese market.

Chinese brands dominate

Among the five brands that were most discussed in the context of Singles’ Day promotions, Volkswagen was the only non-Chinese brand creating high levels of buzz. BYD had a clear lead and secured first place with a share of 16% of total buzz volume, but Volkswagen held strong at second place with 10%. When the top ten brands are considered however, the picture is much more balanced. BMW, Audi and Mercedes take the total number to 4 German brands in the top 10, and the inclusion of Ford broadens the spectrum to include an American brand as well. BMW and Audi share the title of second strongest German car brand with 6% of total buzz volume, followed by Mercedes-Benz with 4%.

Tmall leaves competitors behind

In terms of e-commerce platforms, which are the most discussed topic in connection with car brands, Alibaba’s Tmall ranked first with a 45% share of buzz volume. This was to be expected as Alibaba is China’s undisputed e-commerce market leader and the company that originally launched Singles’ Day.

Competitor JD.com followed in second place with 14%, while consumer electronics retailer Suning.com surprisingly found itself at a strong third place with 12%. Taobao and Pinduoduo shared fourth place with 11%. Car dealers such as Autohome and Bitauto secured relatively weak shares of the total buzz volume with 6% and 1% respectively. Cars are sold on all the named platforms.

International brands generate more interest

Although Chinese consumers talk more often about Chinese brands, they search on average twice as often for information about cars of international brands. “However, we have seen some extreme periodical increases in search volume among Chinese brands,” says Lars-Alexander Mayer, Partner at TD Reply. “These are related to advertising campaigns that Chinese brands carry out at regular intervals and are usually associated with very low purchase prices. During these campaigns, Chinese brands generated up to three times more interest on search engines than their international competitors in the last week. Yet, on average, the latter still generated more interest.“

Increasing relevance for the automotive industry

Following Singles‘ Day, the Alibaba Group announced that this year, over 100 million new buyers from rural areas and economically weaker cities in China were reached. Competitor Pinduoduo reported that rural buyers had bought 1000 cars on its platform within 16 minutes. Taobao even announced that 55 cars were sold in one second through one of its livestreams.

“Overall, we can see that Singles Day has gained in importance for the automotive industry as an advertising and sales platform,” says Lars-Alexander Mayer. “An increasing number of Chinese netizens are discussing the Singles Day’ promotions of various car brands. Particularly important were actions that took place on China’s major eCommerce platforms.”

BACK TO ALL ARTICLES