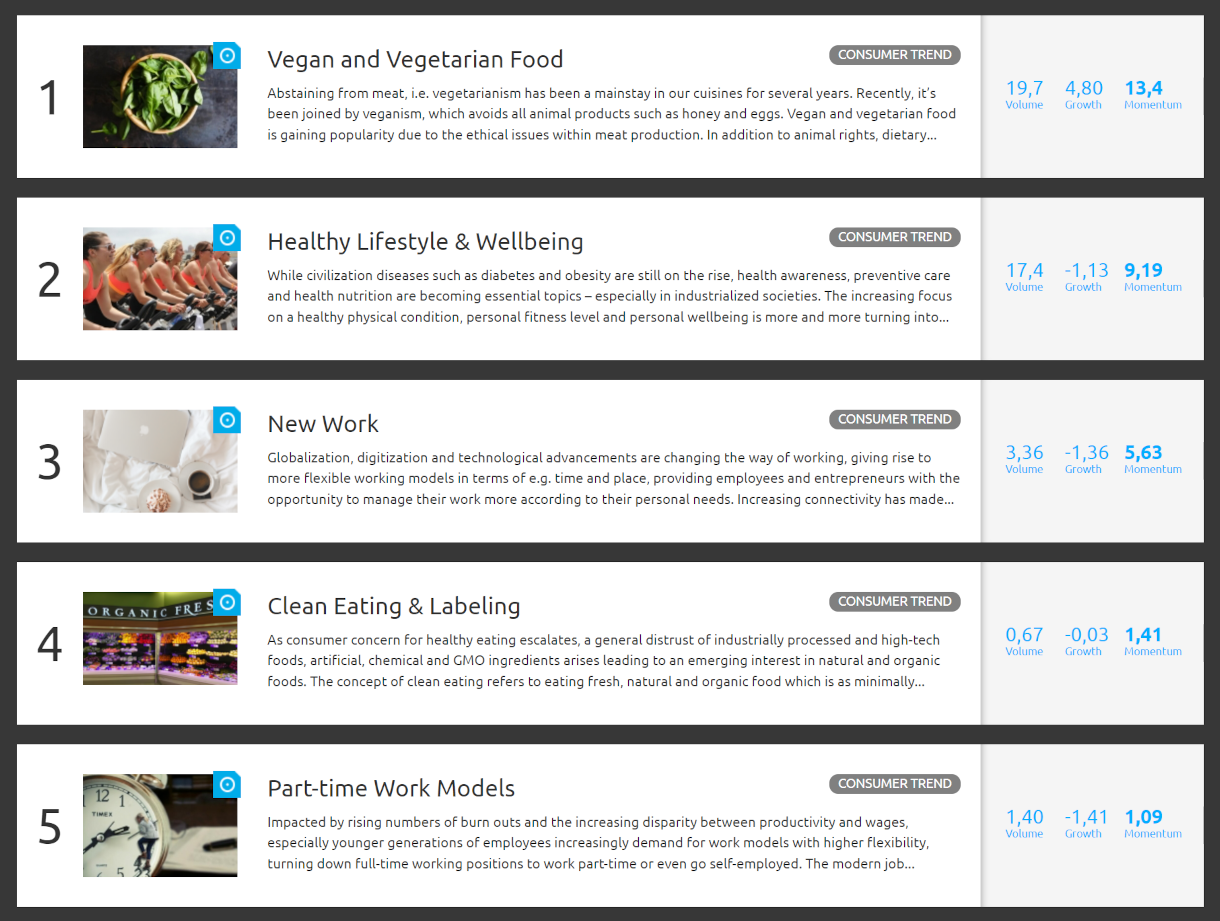

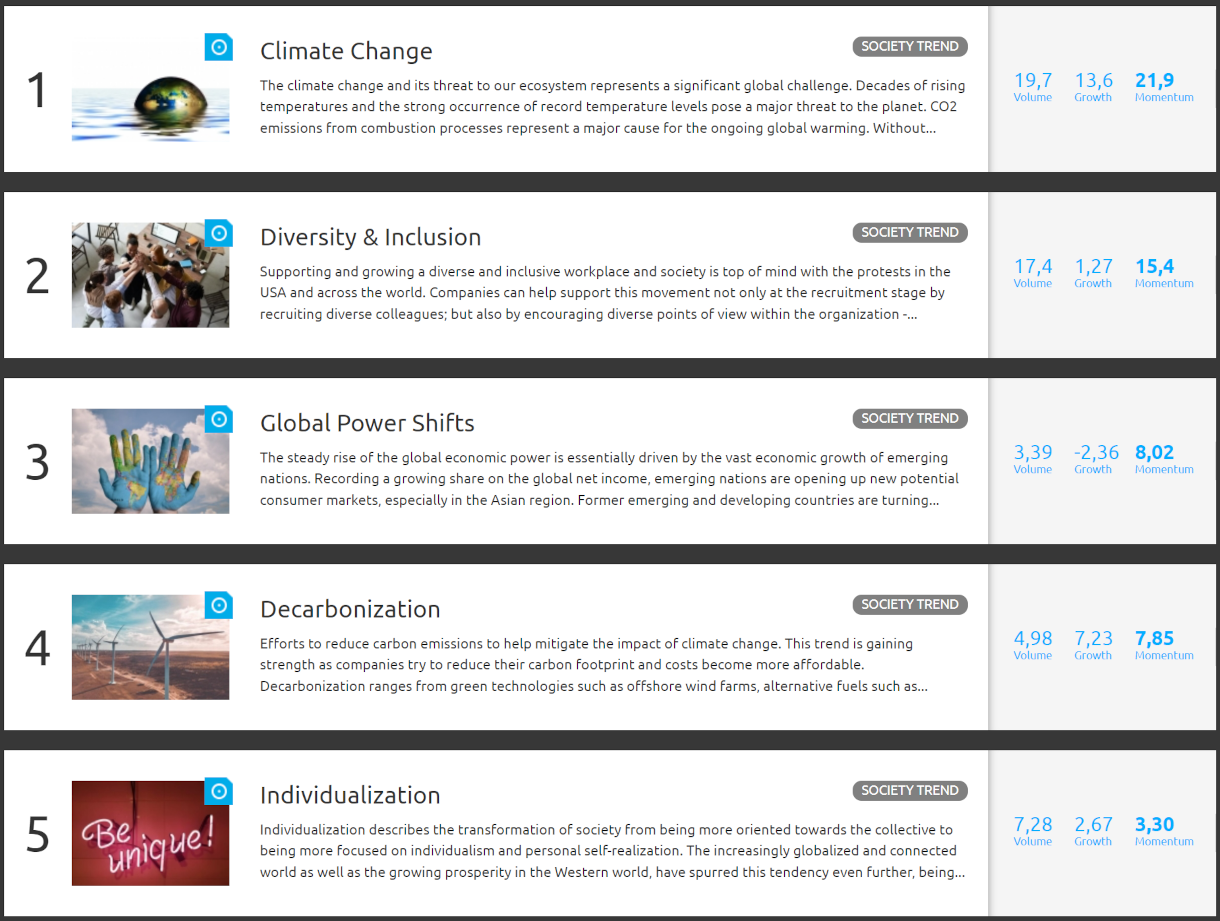

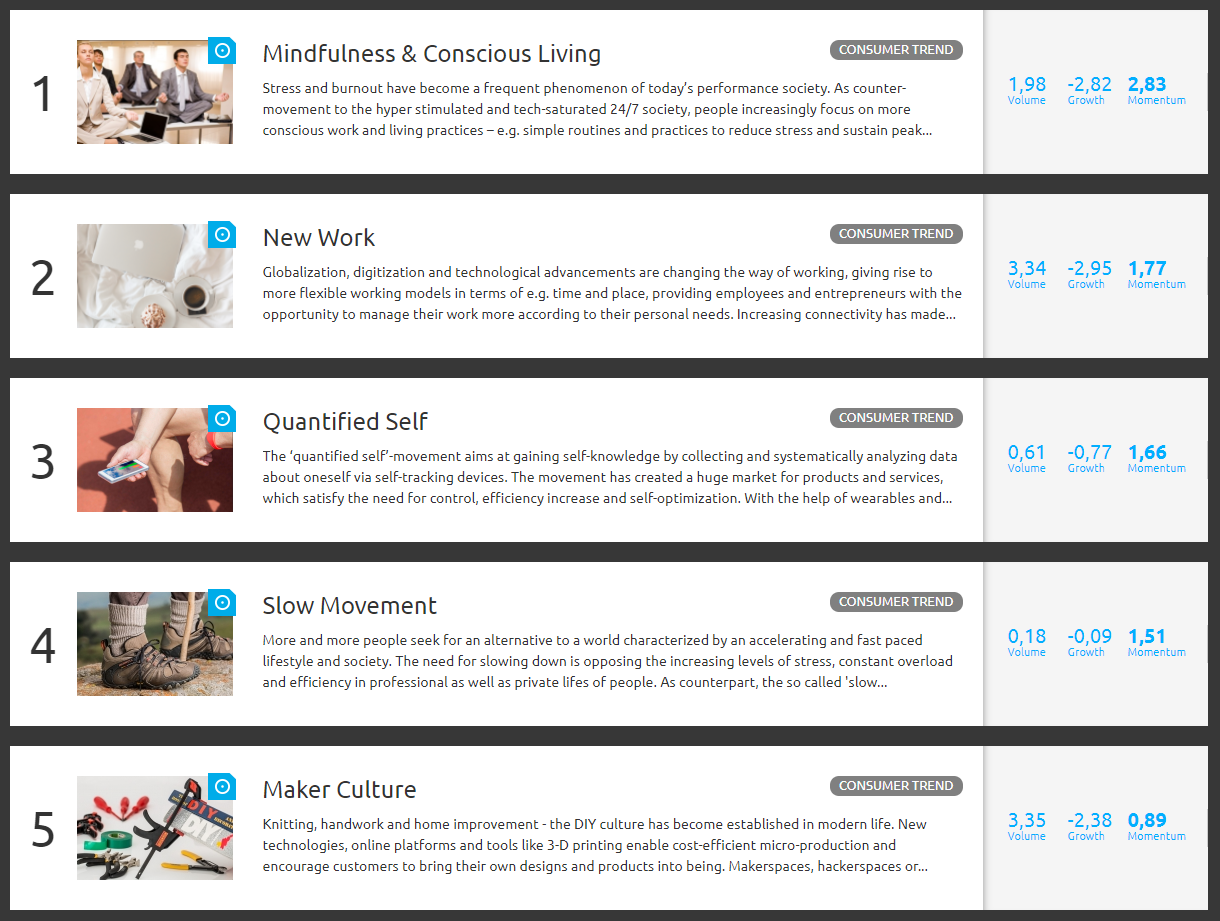

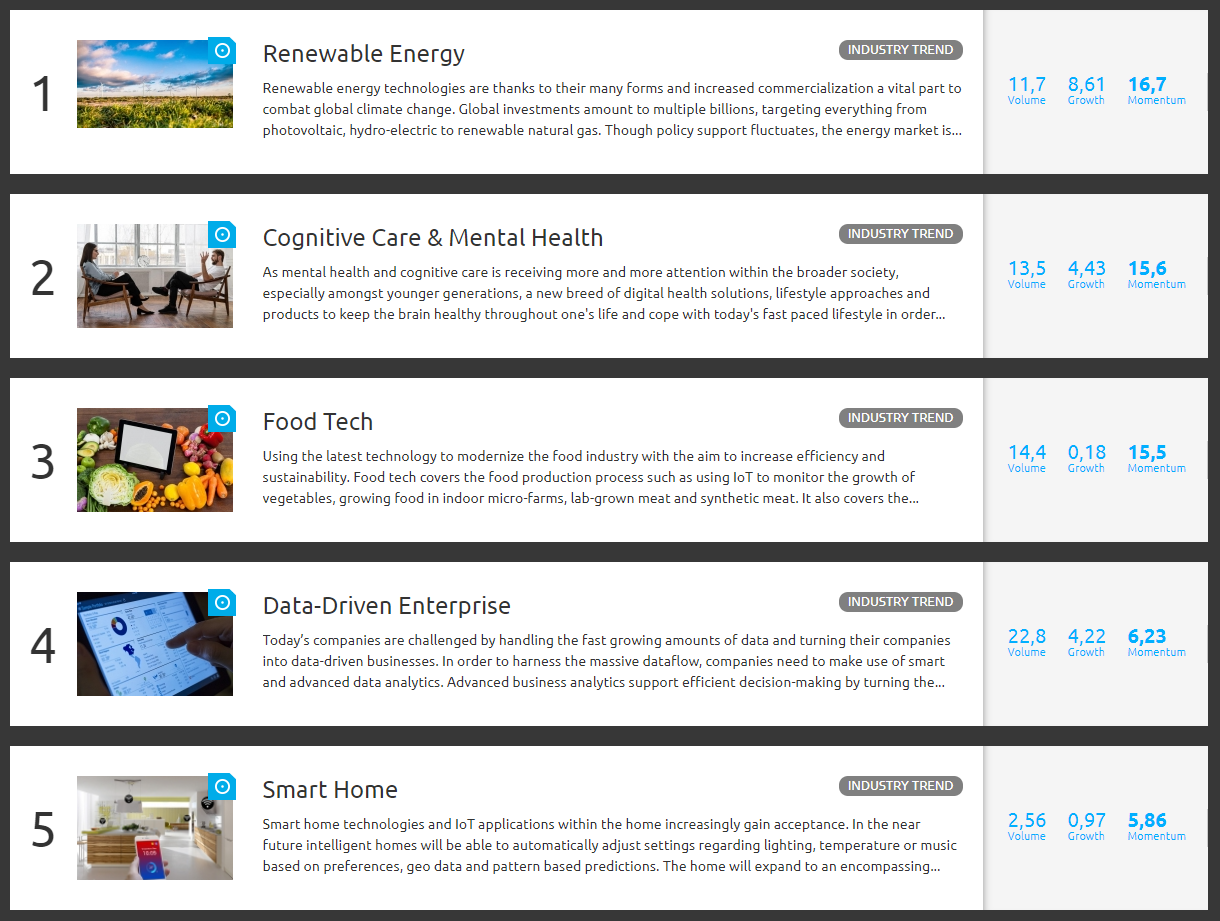

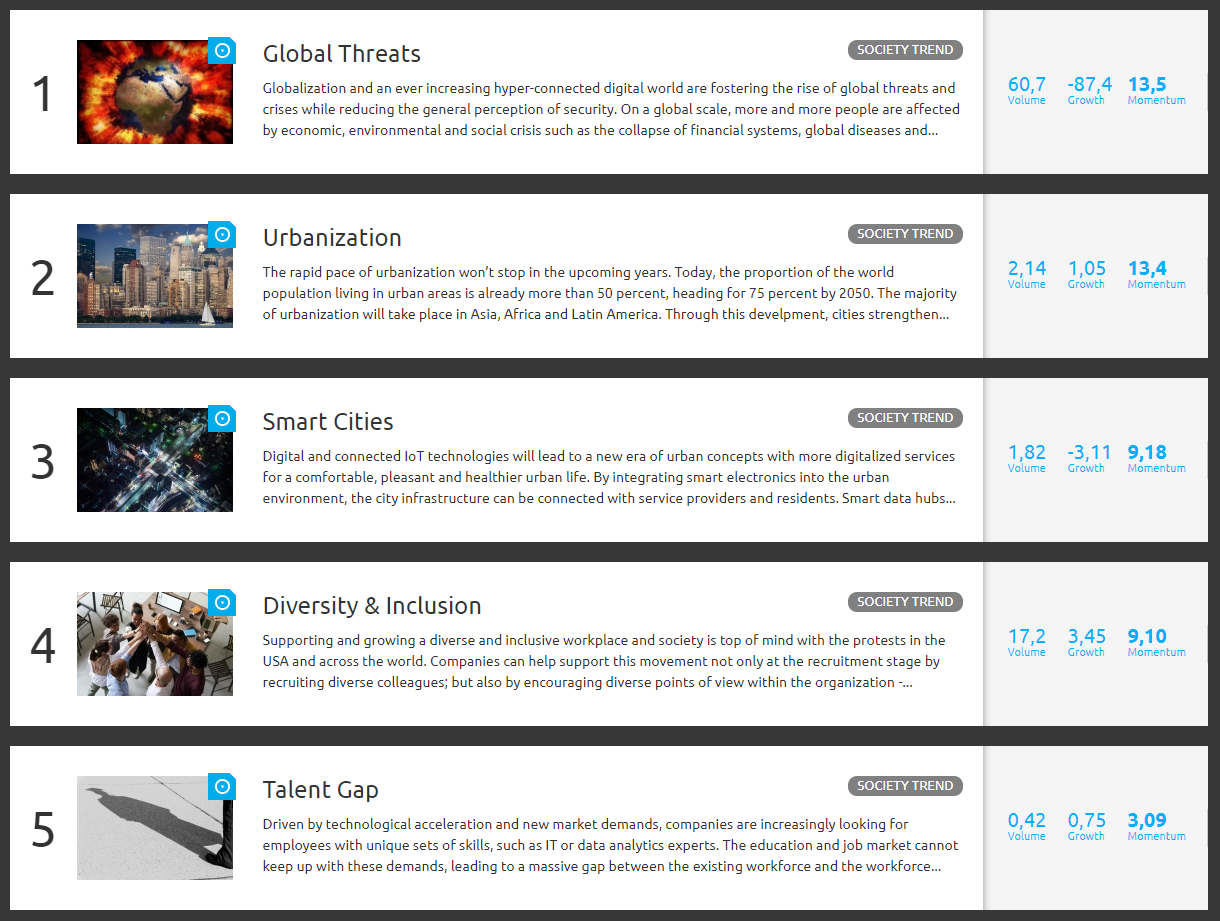

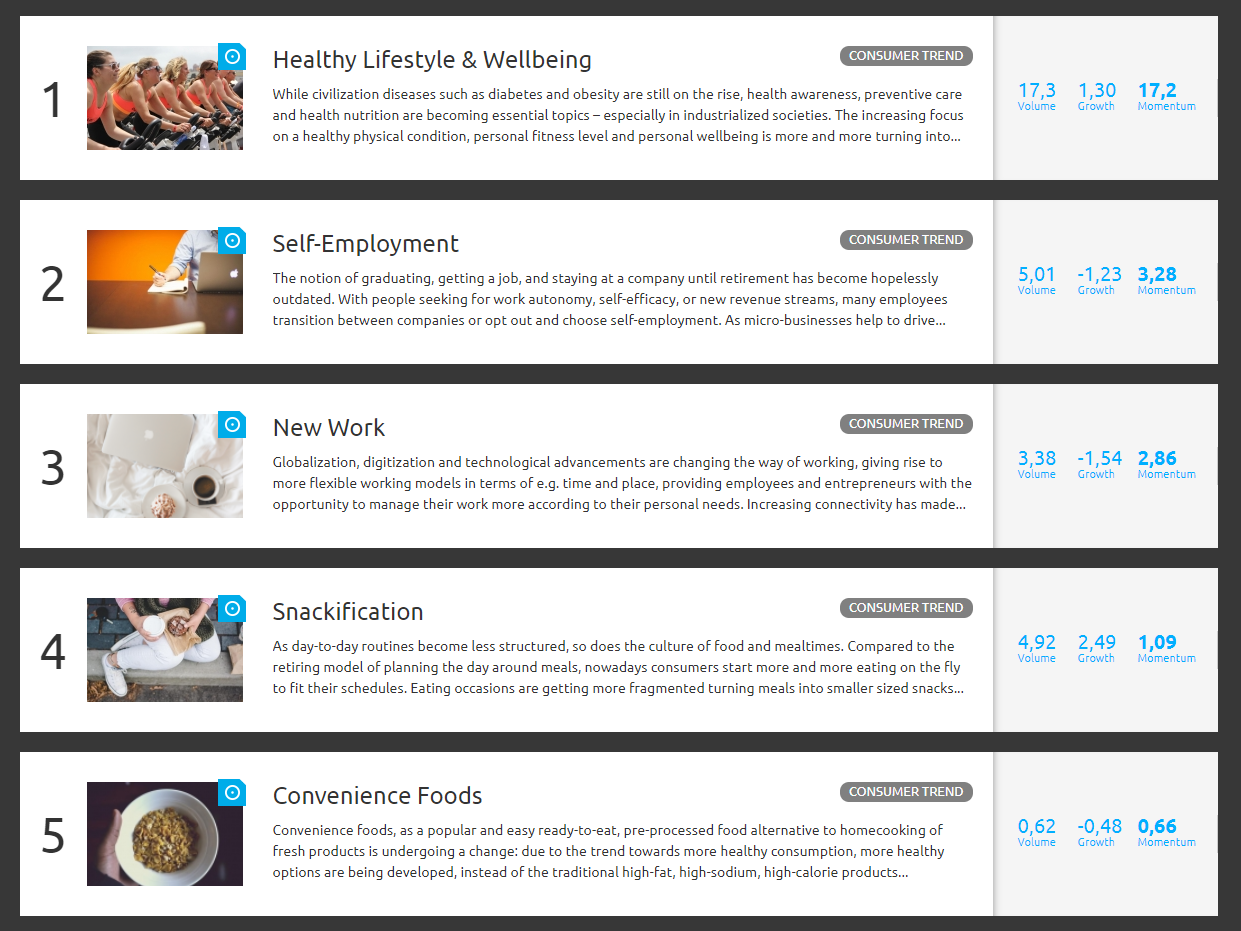

The monthly trend monitor provides a unique data-driven overview over the most important global consumer, industry, and society trends. How it works: We use the SONAR trend radar, which tracks the volume of written scientific and journalistic publications on a certain trend, to find out what the top five trends are in these three categories. Utilizing intelligent algorithms, SONAR analyzes a continuously growing database of more than 40 million publications from academic journals, expert blogs, mass media, and patent registers to gain unique insights on global trends.

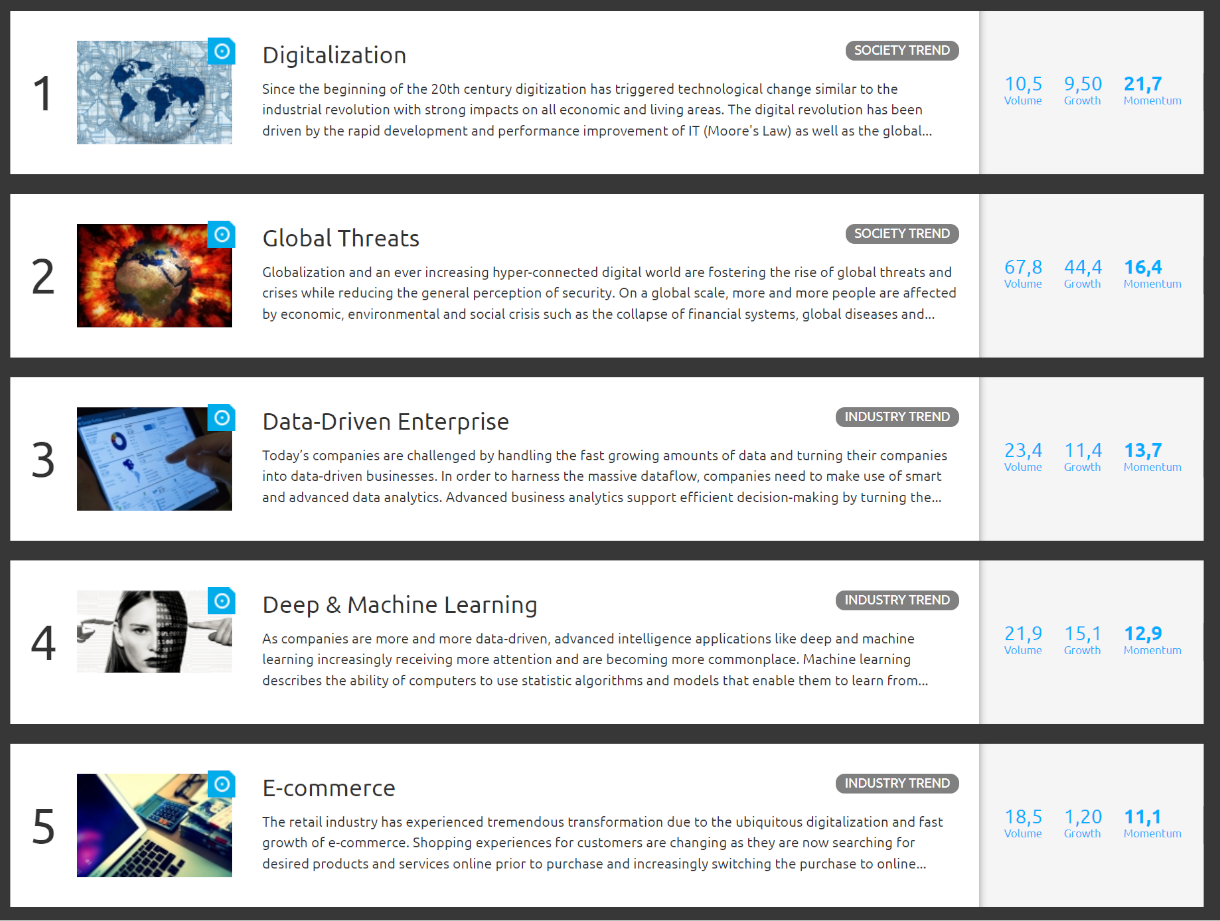

SONAR can sort trends by Volume (number of articles relevant to a trend and relative to the SONAR index), Growth (YoY growth, volume of the last 12 months vs. previous 12 months) or Momentum (MoM growth, volume of the last month vs. volume of the previous month).

Each month, we present the top 5 consumer, industry, and society trends by Momentum.

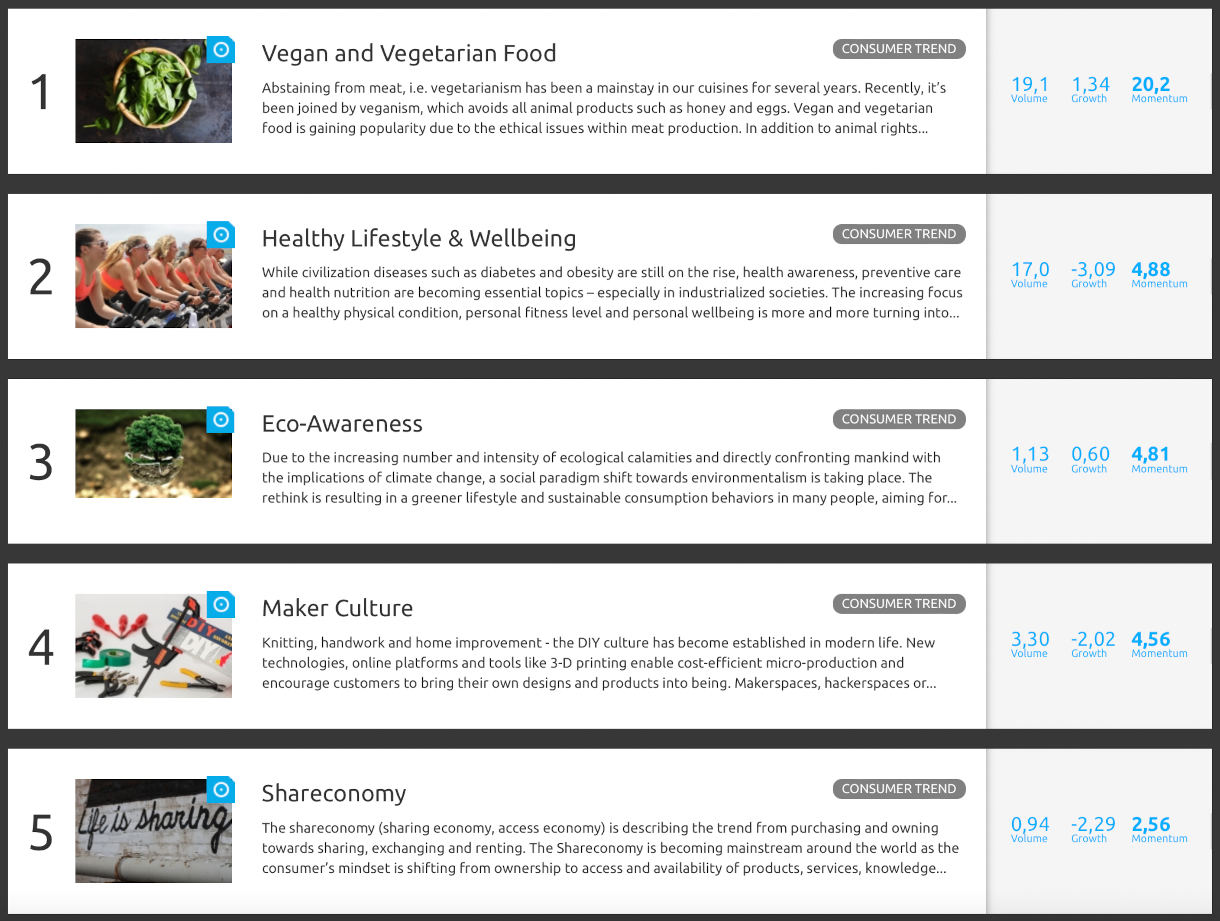

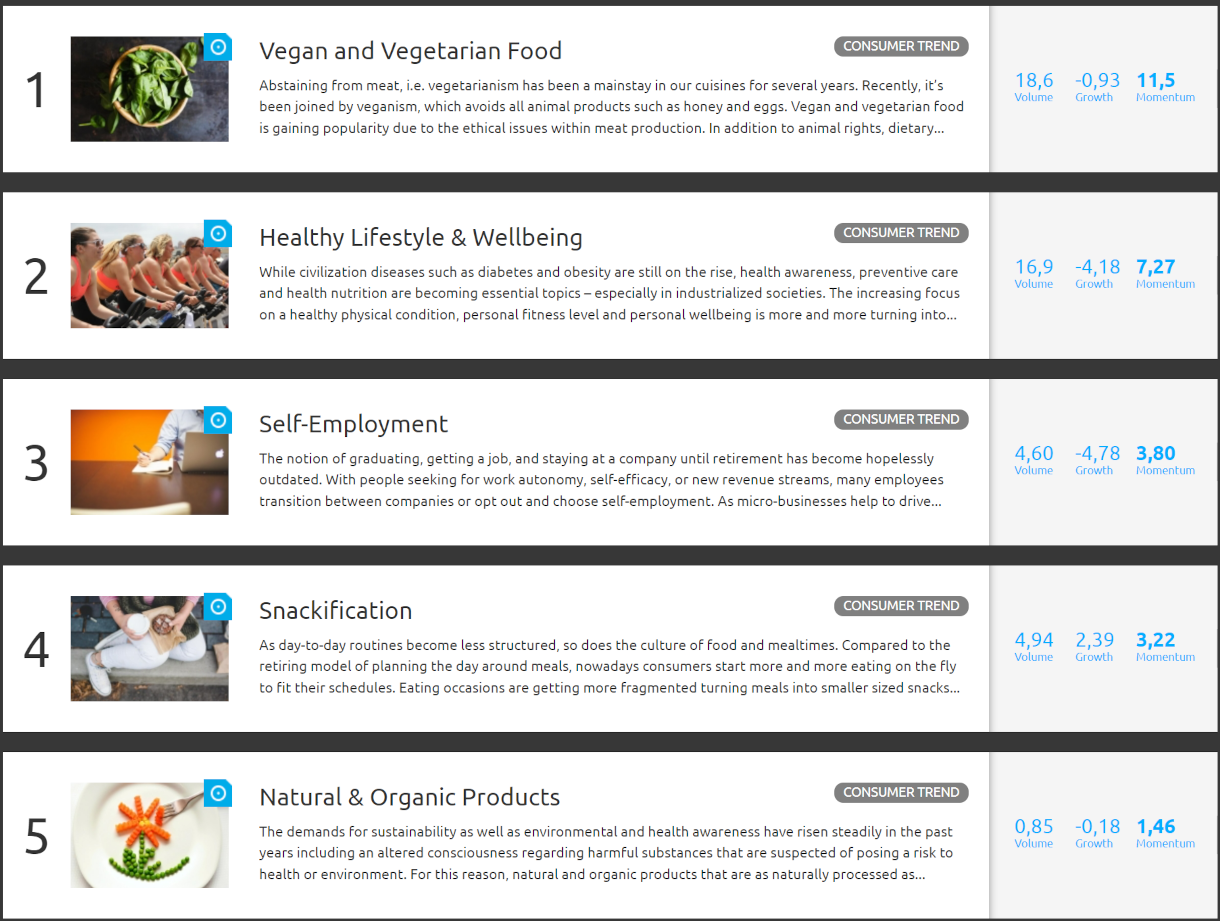

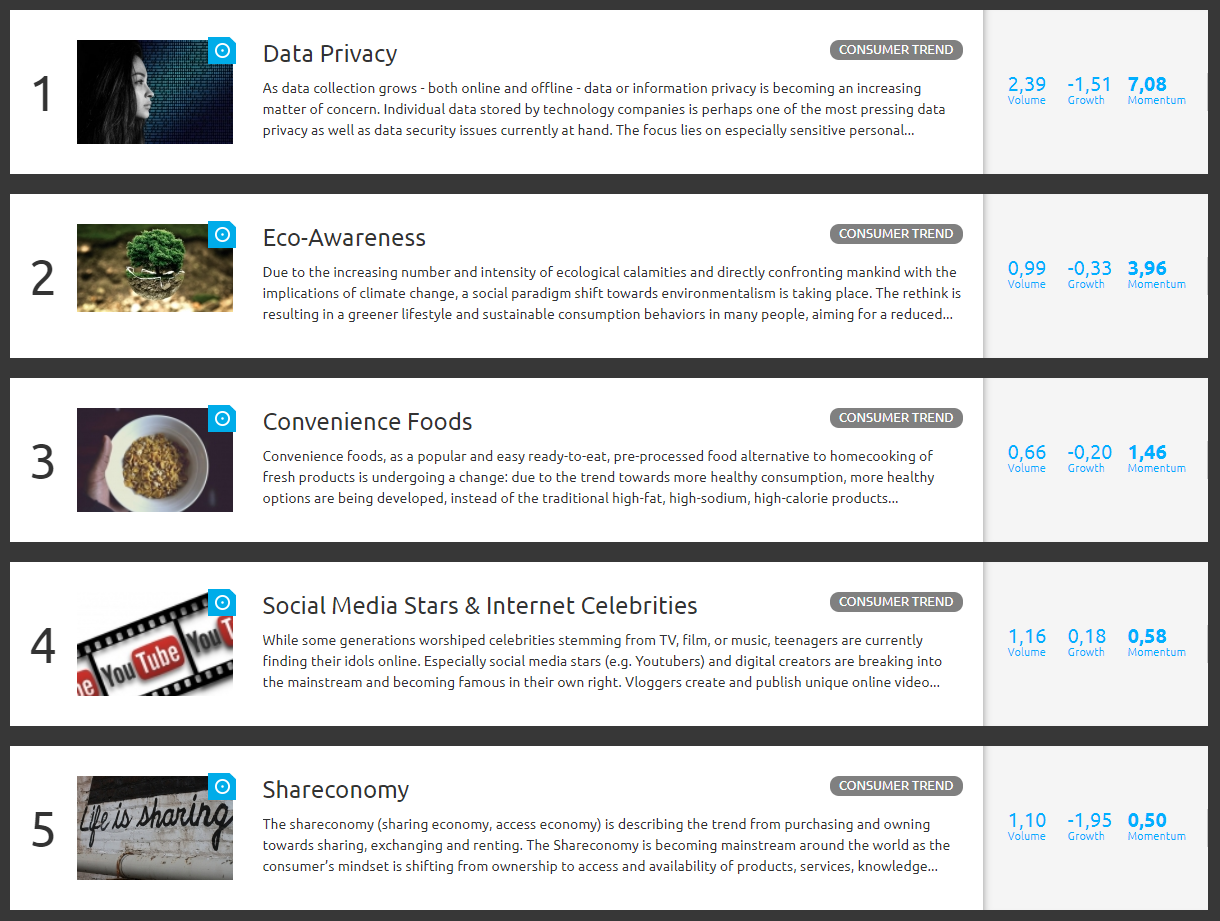

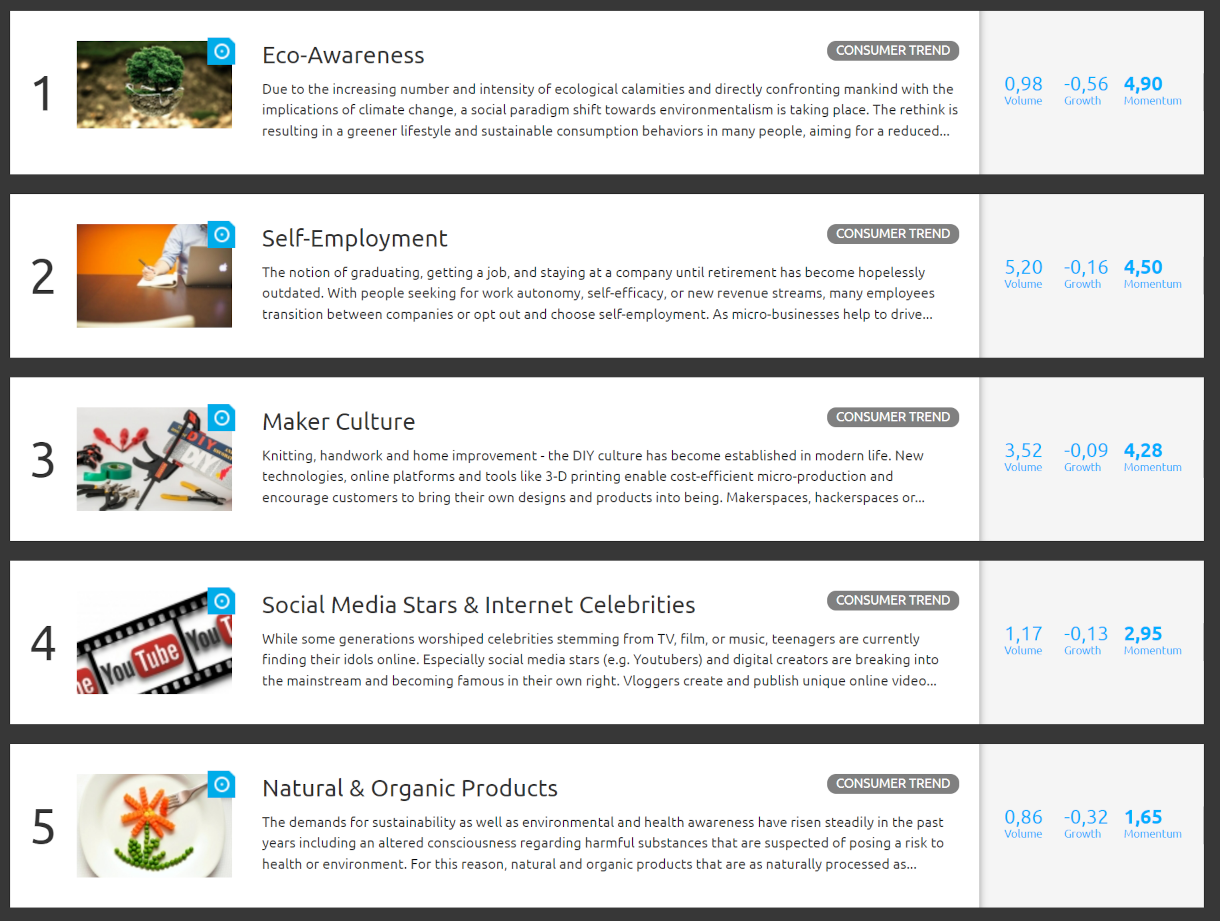

Top 5 Consumer Trends in August 2022

None of the July’s top consumer trends have managed to maintain a strong enough momentum to make it to the top five in August. The top consumer trends in August are Eco-Awareness, followed by Snackification and Data Privacy.

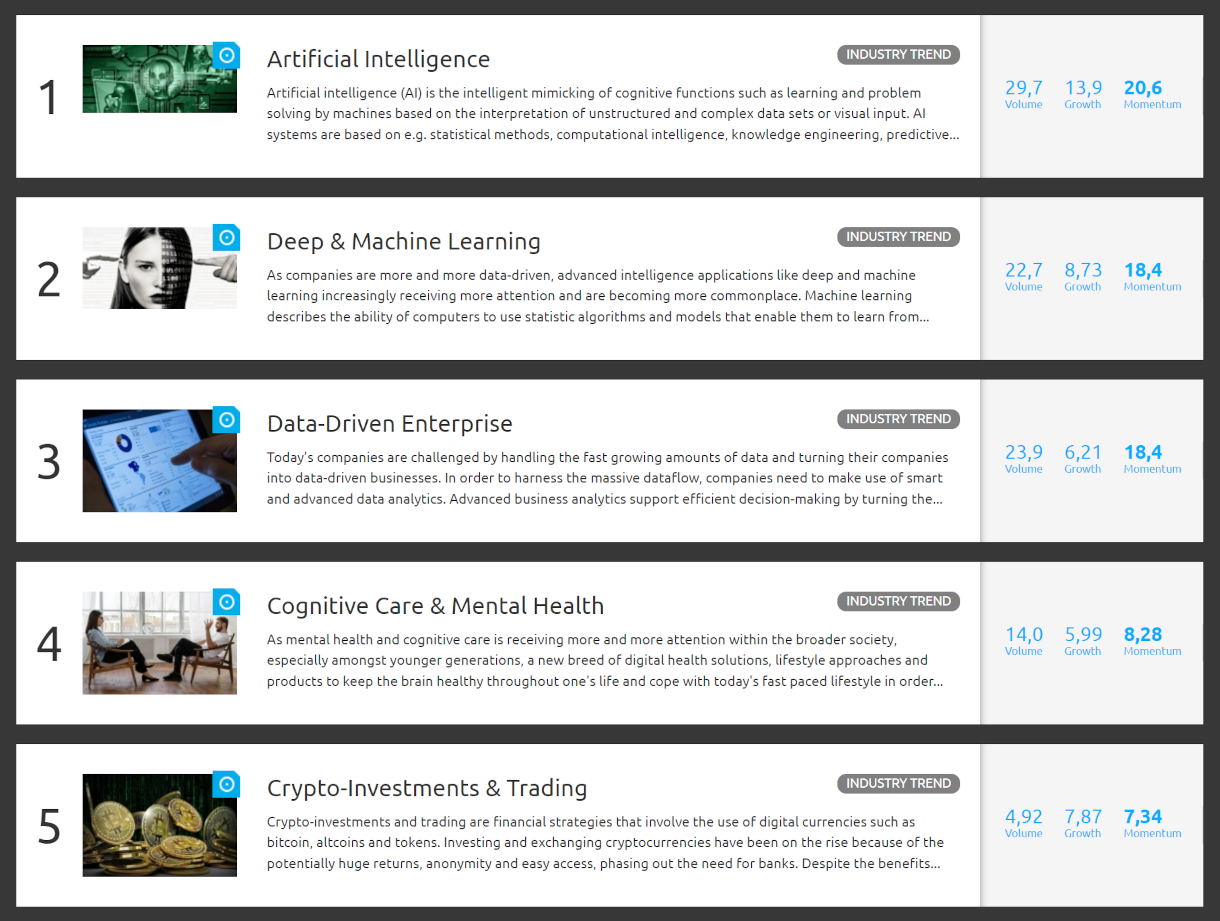

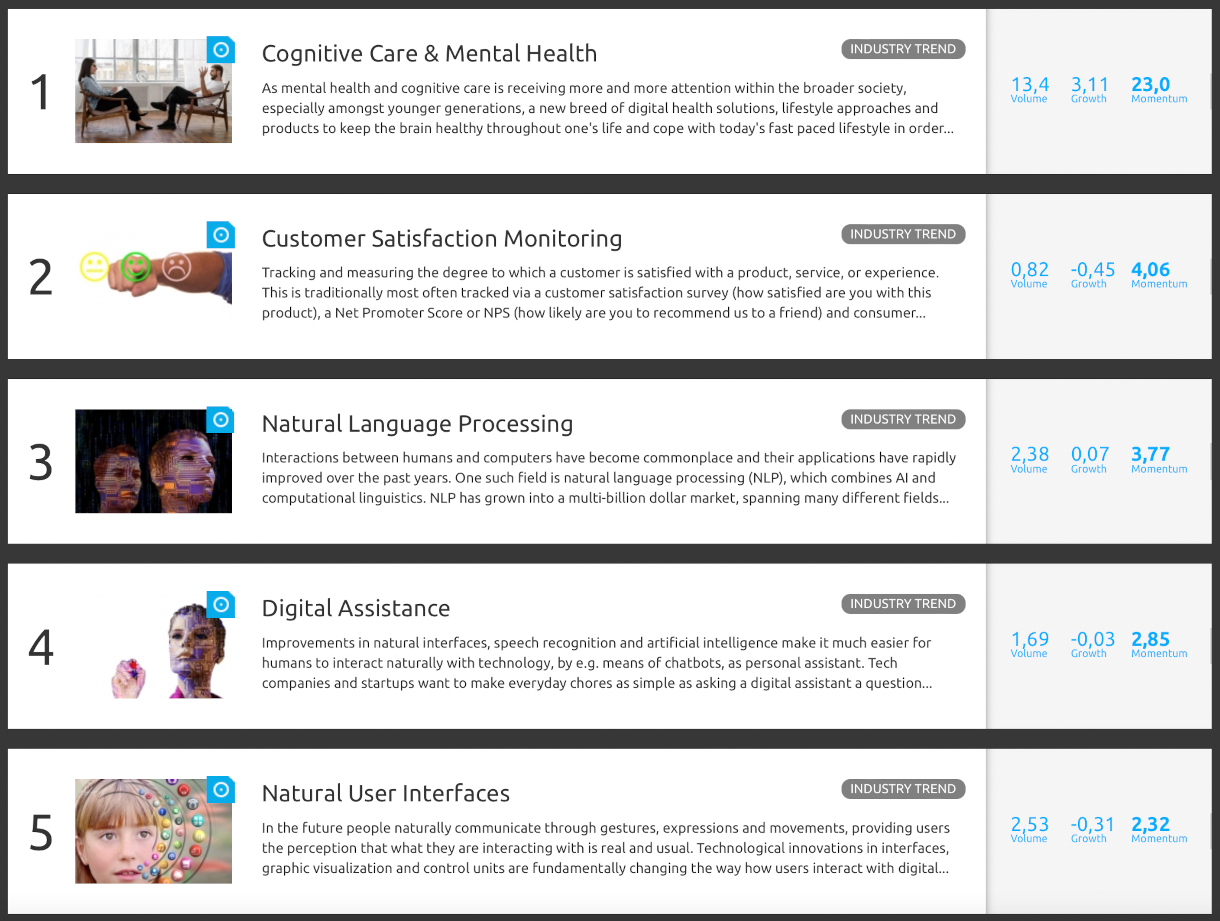

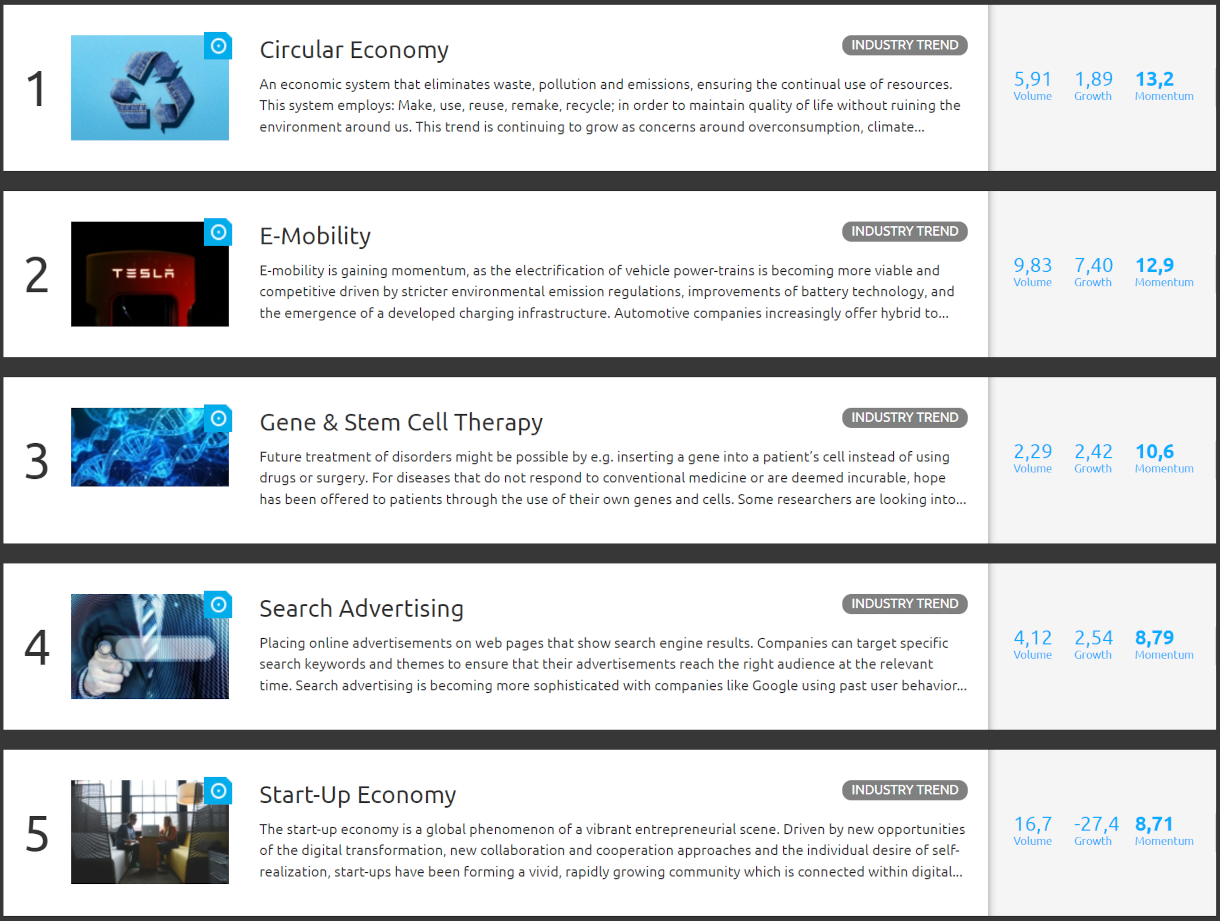

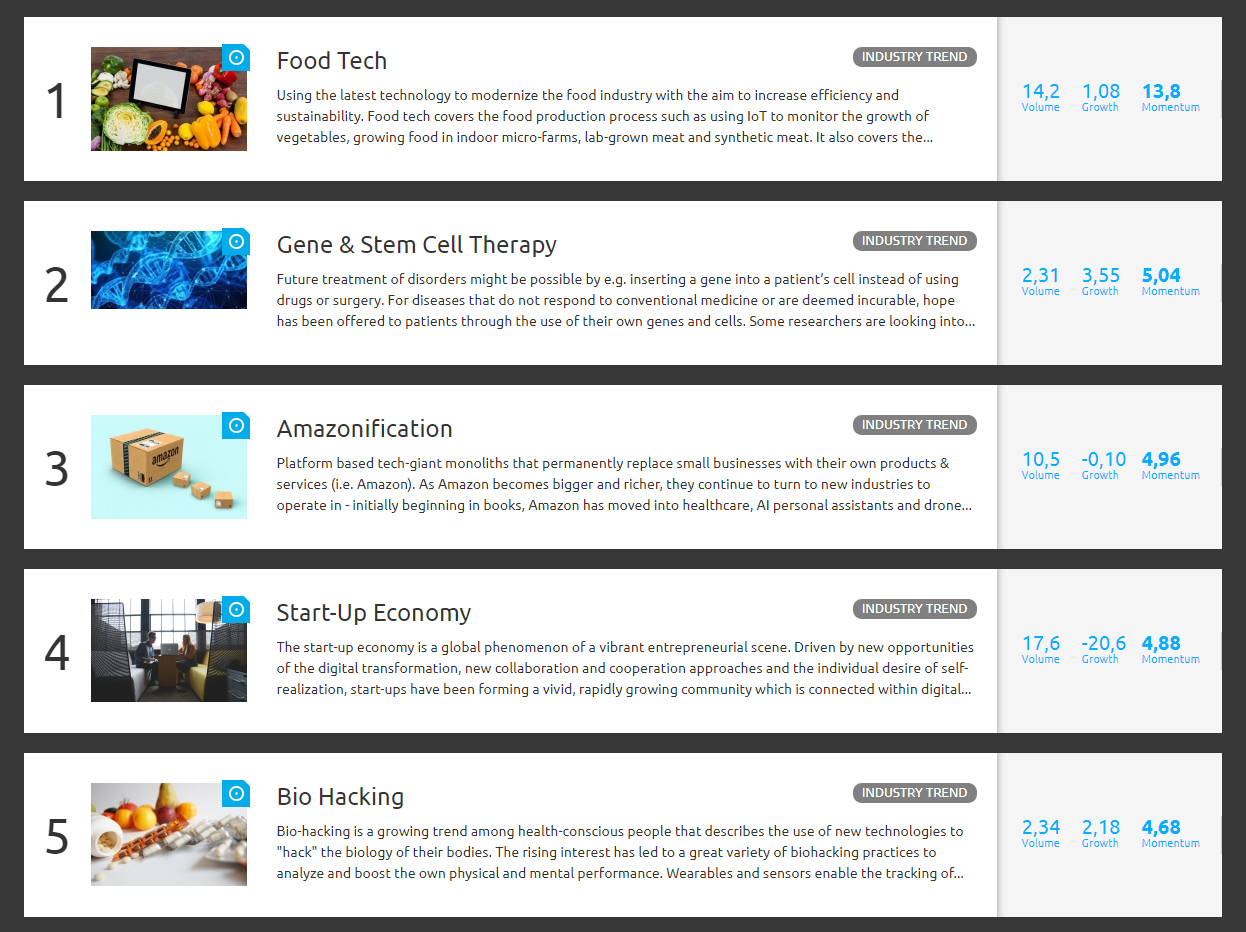

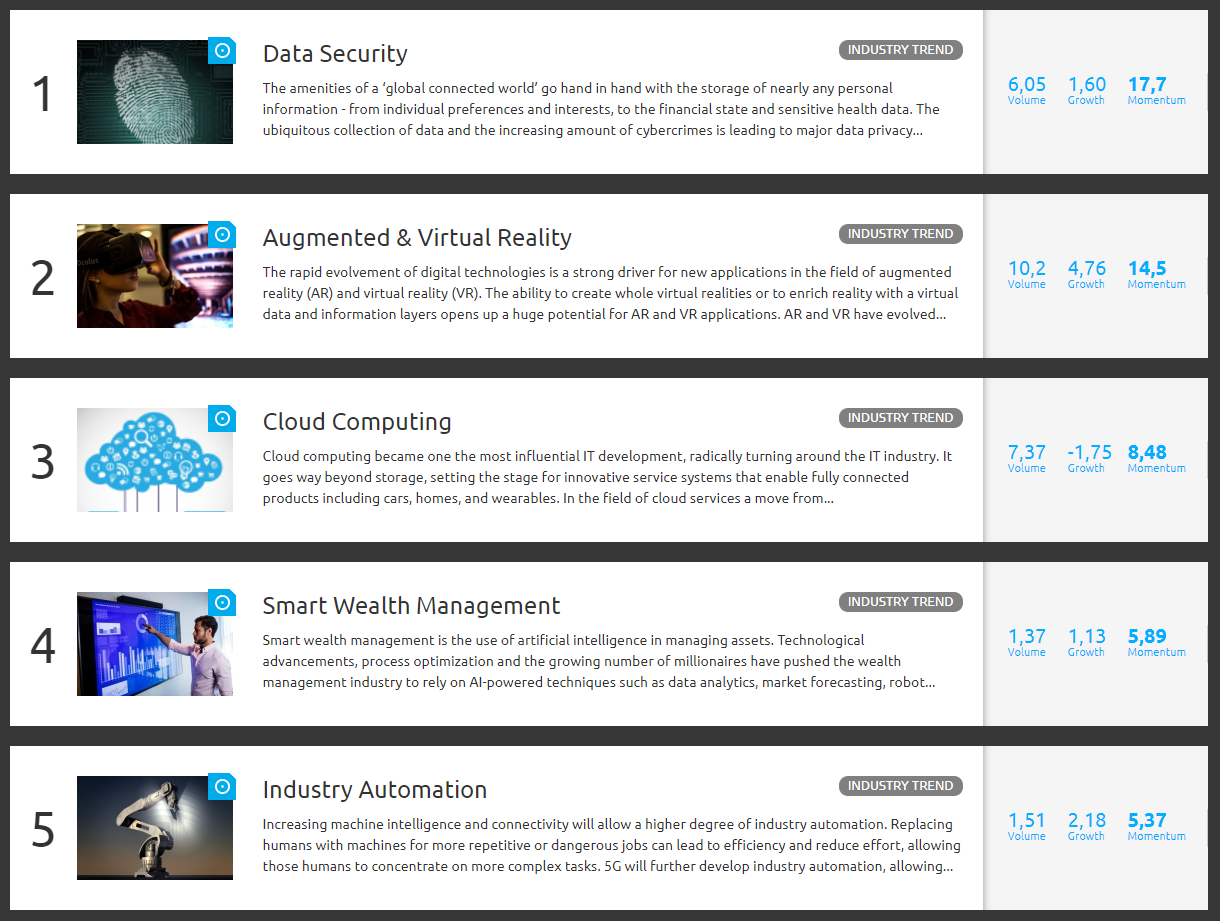

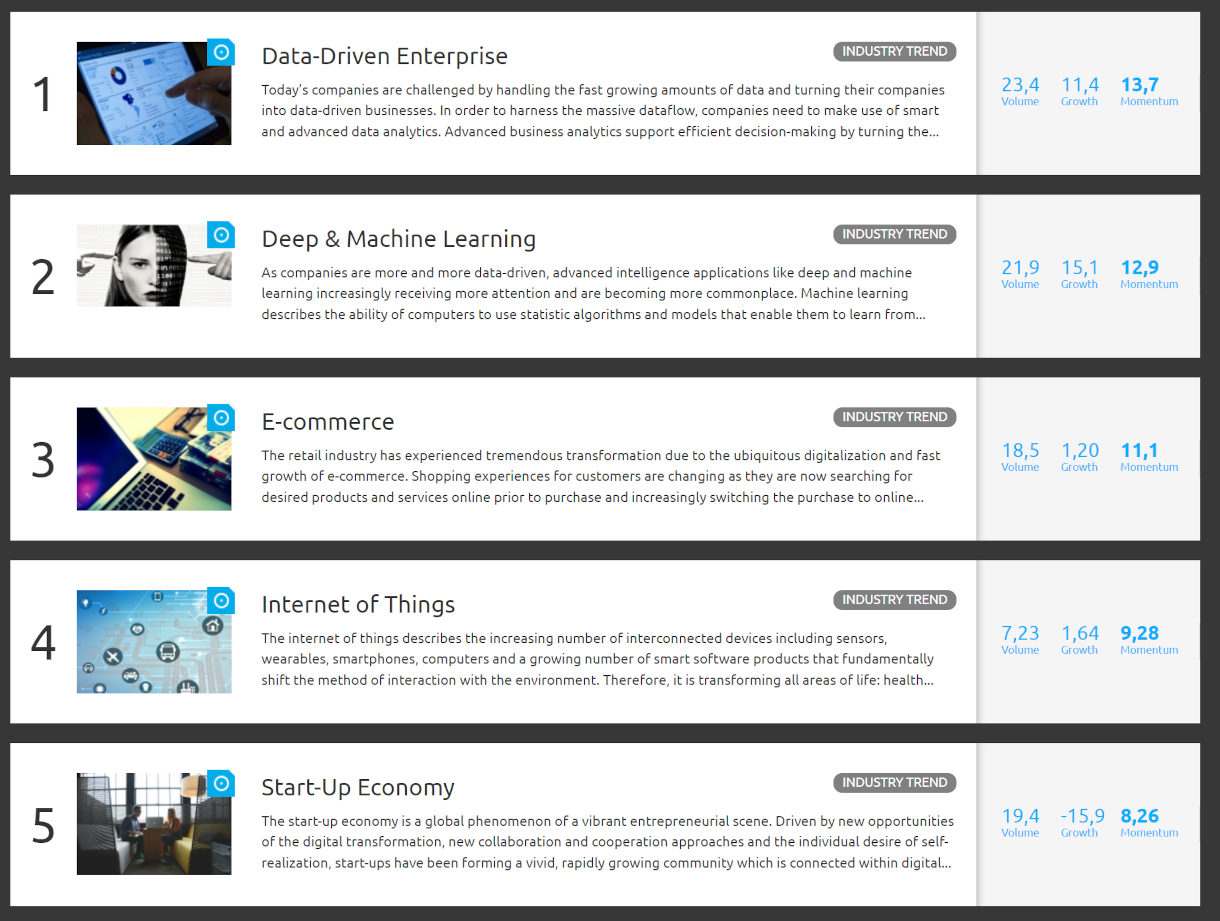

Top 5 Industry Trends in August 2022

The ranking of the top five industry trends has also seen a complete reconfiguration. Food Tech takes over the pole position from Artificial Intelligence and boasts a very strong momentum. E-commerce follows closely with only a slightly lower momentum.

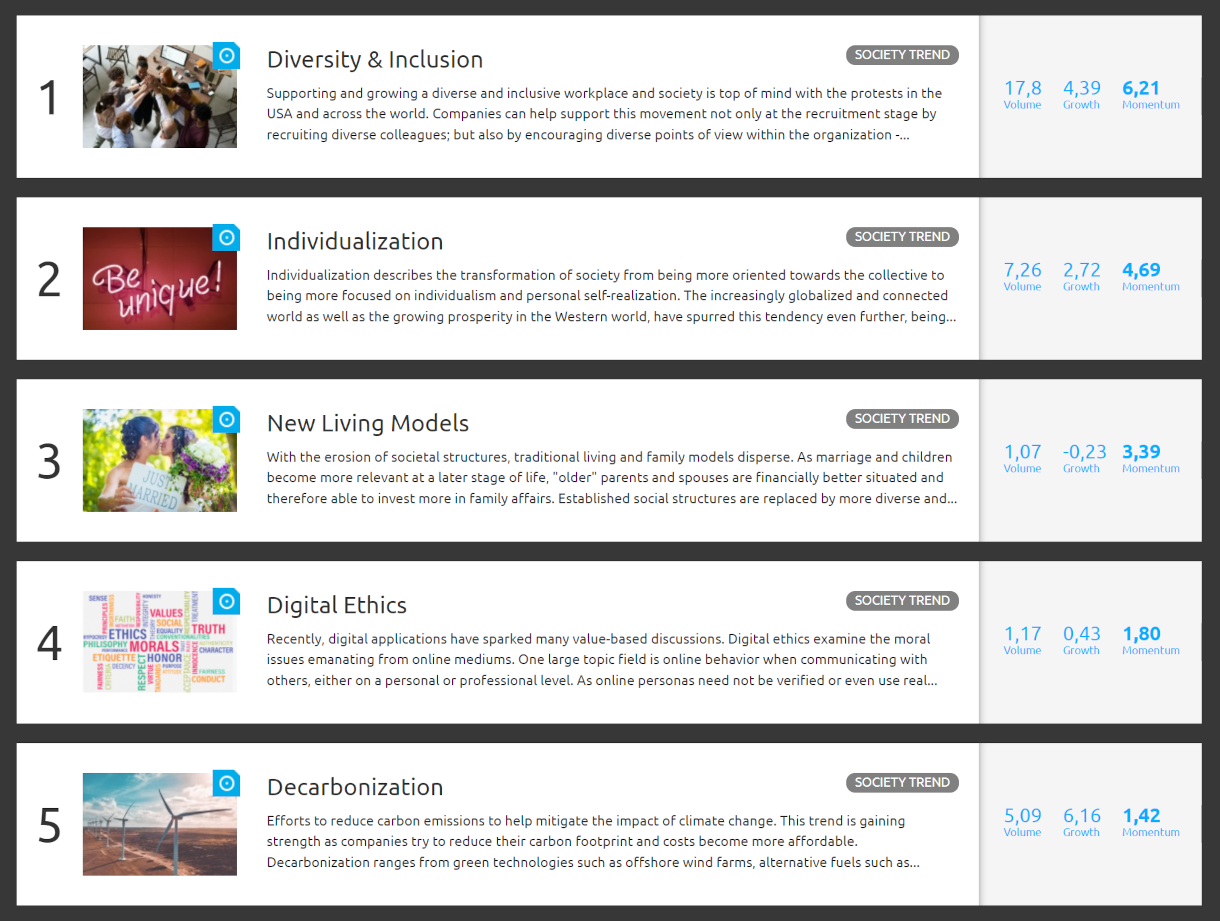

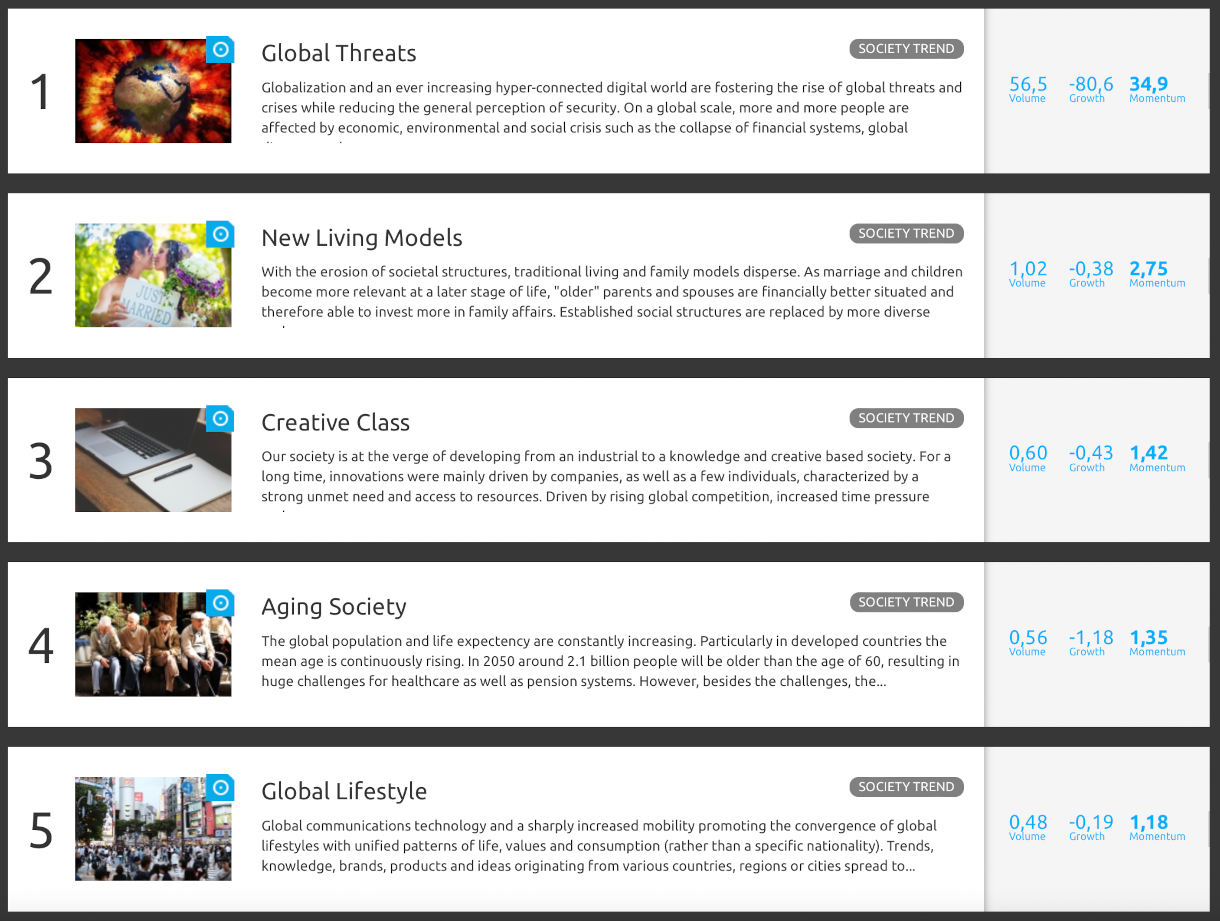

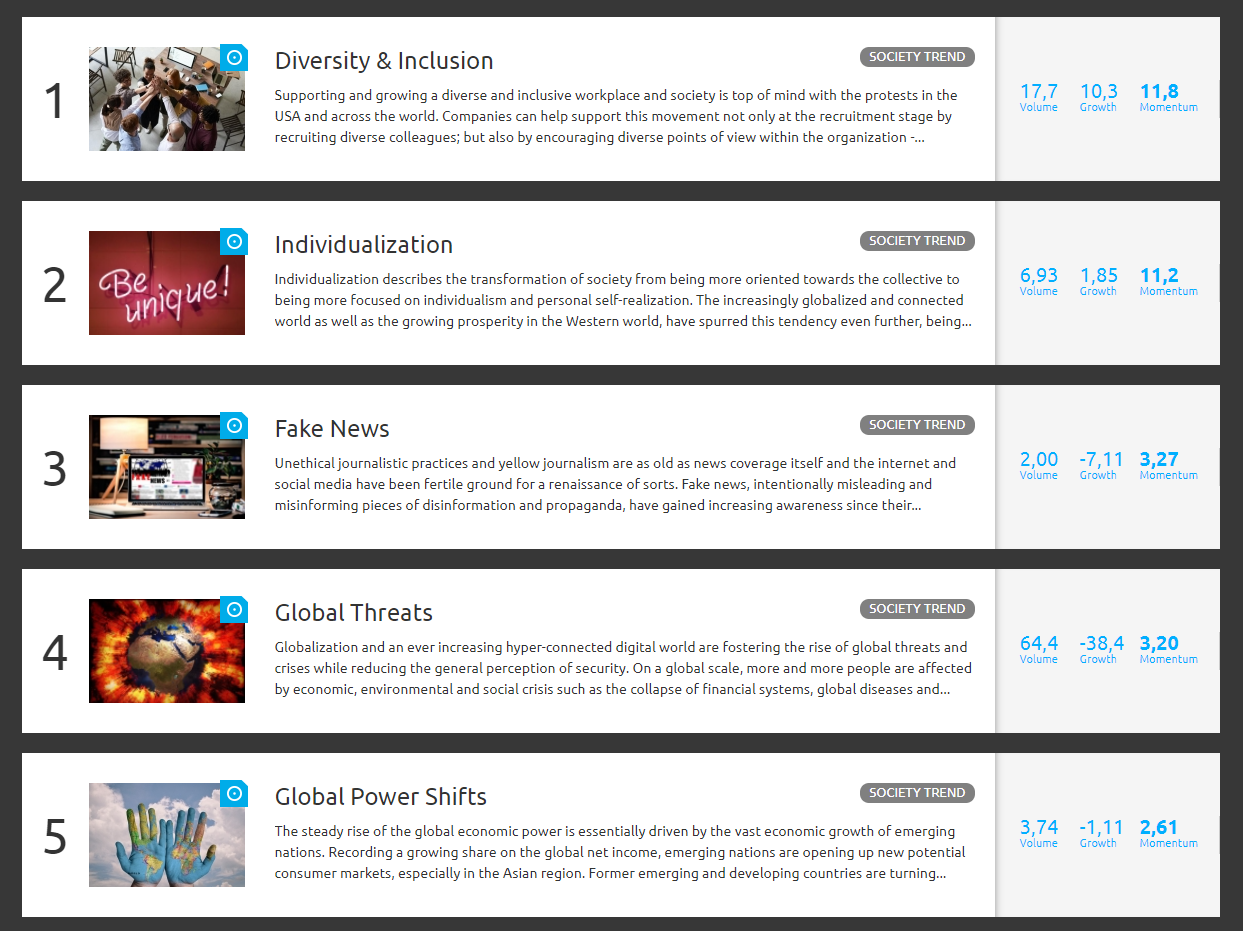

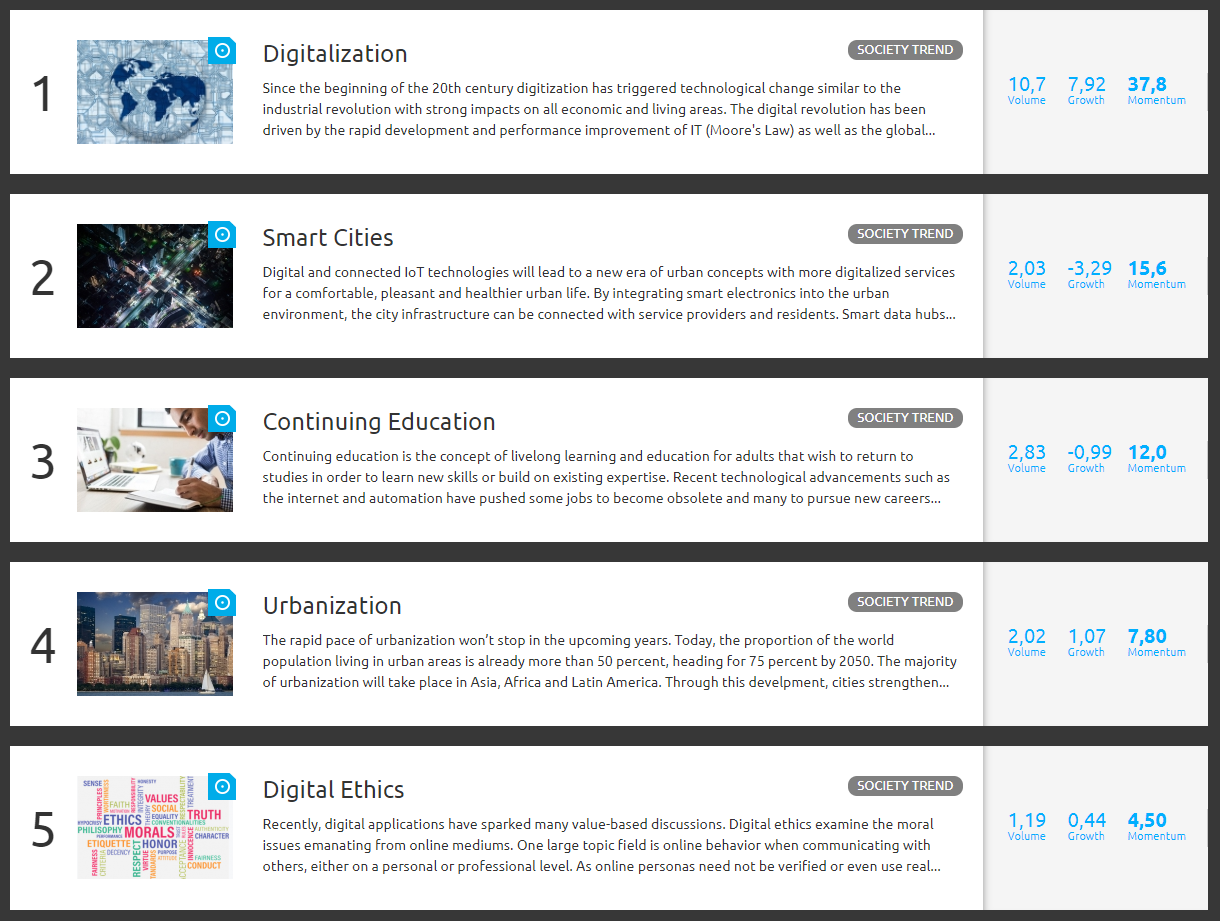

Top 5 Society Trends in August 2022

The number one society trend Digitalization and runner-up Climate Change both boast exceptionally strong momentum in August. Fake News and Right Wing Populism, two trends rarely seen in the top five, take the fourth and the fifth positions, respectively.